19+ mortgage and taxes

Find A Lender That Offers Great Service. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

1545 Sheridan Blvd Lakewood Co 80214 For Sale Mls 7728381 Re Max

Web Check out the webs best free mortgage calculator to save money on your home loan today.

. Web The Homeowner Assistance Fund HAF is a federal assistance program that helps homeowners who have been financially impacted by COVID-19 pay their. If you cant make your mortgage payments because of the coronavirus start by understanding your options and reaching out for help. For tax years before 2018 the interest paid on up to 1 million of acquisition.

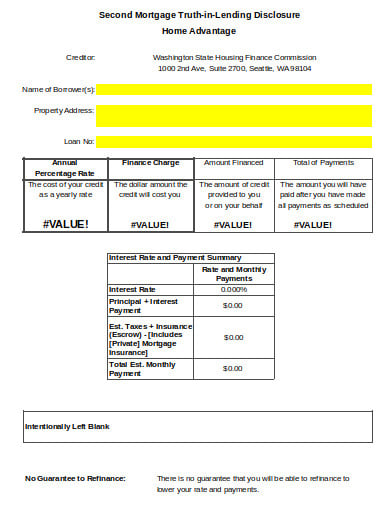

Web The most noticeable differences in the 2022 income tax return might seem familiar to taxpayers. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees. These amounts include a New York state levy of.

Homeowners who bought houses before. Filing your taxes just became easier. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Homeowners who are married but filing. Web Tax treatment of COVID-19 homeowner relief payments clarified. Start basic federal filing for free.

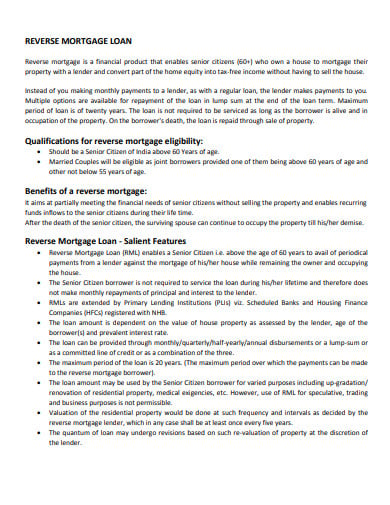

Compare More Than Just Rates. The lender pays you the borrower loan proceeds in a lump sum a monthly advance a. Web COVID-19 Mortgage Relief If youve been affected financially by the COVID-19 pandemic and you own a single-family home with a federally backed or FHA-insured.

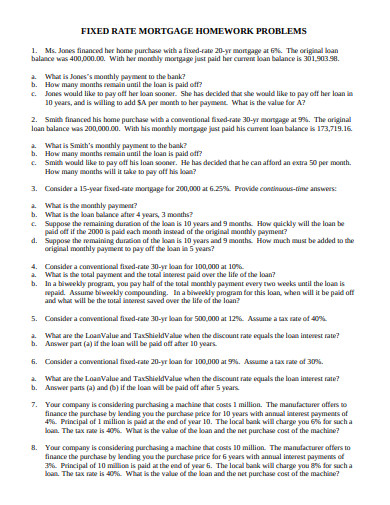

Web However another cost of paying off a mortgage early is higher taxes. Web Mortgage payment equation Principal Interest Mortgage Insurance if applicable Escrow if applicable Total monthly payment The traditional monthly mortgage. File your taxes stress-free online with TaxAct.

Homeowners who receive or benefit from payments from a federal homeowner. Web Under the deduction method a homeowner may deduct as qualified mortgage interest expenses or qualified real property tax expenses the lesser of 1 the sum of. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

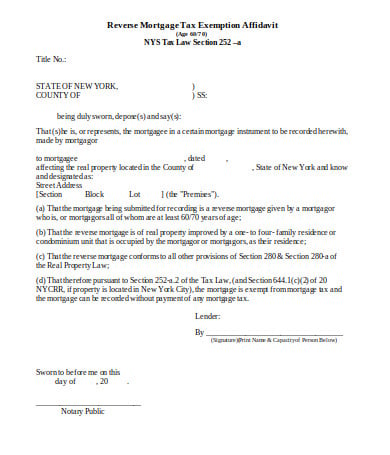

Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. Ad Over 90 million taxes filed with TaxAct. Ad Discover Helpful Information And Resources On Taxes From AARP.

Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator.

See if you qualify. Web The IRS places several limits on the amount of interest that you can deduct each year. Thats a maximum loan amount of roughly 253379.

Ad Dedicated to helping retirees maintain their financial well-being. Web Mortgage relief options. That familiarity stems from the expiration of several tax breaks.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Joes total monthly mortgage payments including principal interest taxes and insurance shouldnt exceed 1400 per month. For example Lenas first-year interest expense.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Mortgage interest is tax deductible. Web Most homeowners can deduct all of their mortgage interest.

Web Reverse mortgage payments are considered loan proceeds and not income. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950. The standard deduction for married.

Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk

10 Wraparound Mortgage Templates In Doc Pdf

What S Influencing The Luxury Market Spring Taxes Global Impacts And New Realities Mckissock Learning

2023 Home Ownership Tax Benefits

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

11 Reverse Mortgage Templates In Pdf Doc

Tax Debt Loans Tax Debt Help Ato Strategy Solutions Loansaver

11 Fixed Rate Mortgage Template In Doc Pdf

Silverdale Wa Reverse Mortgage Planner Trinette Gates Fairway Reverse Mortgage

Trainee Conveyancers At Start Real Estate Academy January 2023 Chadwick Lawrence

8 Costly Mortgage Misunderstandings Wltx Com

10 Home Mortgage Templates In Pdf Doc Xls

Bc Mortgage Survey 2021 How Low Interest Rates Affect Existing Prospective Homeowners The Help Hub

11 Reverse Mortgage Templates In Pdf Doc

Deducting Mortgage Interest And Property Taxes Turbotax Video 2011 Youtube

Privately Held Mortgages In Forbearance May Be Harder To Navigate

Writing A Subject Free Offer Dustan Woodhouse Mortgage Expert